News

As the crypto space is bracing for the next bull run, we make the case for why it will be driven by real-world applications – now known as DePIN (Decentralized Physical Infrastructure Networks).

In a nutshell: The crypto world is gearing up for another bull run, looking at the SEC’s suspenseful musings on a Bitcoin ETF and the upcoming Bitcoin halving as the two main catalysts. But analysts warn that these events may not be enough to sustain the bull run, as it does nothing to change crypto’s status as a speculative asset. That’s where DePIN comes in. By tying Web3 with real-world supply and demand, DePINs will give the crypto community the fundamentals it needs and deserves.

The Age of the Bear has not been merciful, but a great bull army is coming to change the tide — and leading them on, we’re sure, is a hero of a humble name. DePIN is the Frodo Baggins of crypto, an unassuming protagonist destined to change the world – and in the coming bull run, DePIN will take center stage.

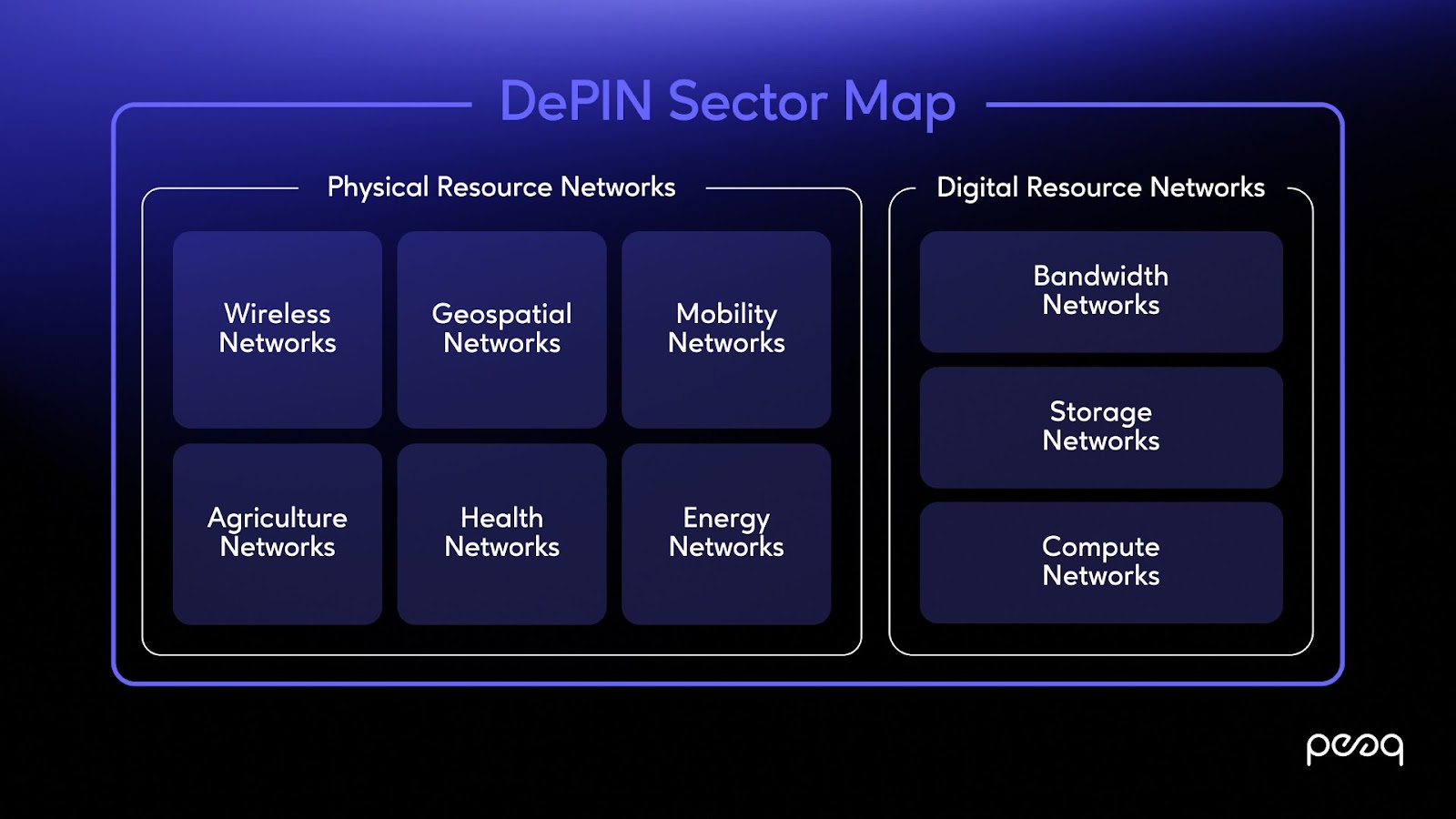

Short for Decentralized Physical Infrastructure Networks, a DePIN is a decentralized application that uses tokens to incentivize people to crowdsource and build connected real-world physical infrastructure.

DePIN is also a scaling model – a way for a project to bootstrap its way to mass adoption without the need for up front capital.

And now, as the bull run approaches, DePIN is becoming a movement. It is the answer to naysayers insisting blockchain and crypto have no real world application, or just a place for gamblers and speculation.

DePINs use token-based incentives to crowdsource the deployment and maintenance of real-world infrastructure providing real-world services to real people in the real world. See how many times we used the word ‘real’?

In other words, DePINs enable people to set up and run all sorts of devices, from AI-powered cameras to green energy hardware, to offer real-world services, from collecting traffic data to providing green energy-backed carbon credits, and they do this cheaper, faster, more securely and can achieve greater scale faster than traditional infrastructure projects.

Just to throw in some numbers, the DePIN market is on course to be a $3.5tln market by the turn of the decade, according to Messari.

The carbon credit market is projected to grow to $145 billion by 2030, which makes for a ton of liquidity for DePINs to tap into. Shared mobility, another market where DePINs are already coming out strong, is projected to reach $1.68 trillion by 2027. Noise monitoring market is projected to climb over $1 billion in the coming years, and what do you know, there’s also a DePIN for that, building on peaq, the DePIN home.

You get the point.

DePIN ties Web3 with real-world value generation and real-world supply and demand, the very same things that unde(r)pin your regular business processes. Behind these tokens is more than pure speculation — there are real people and machines creating real value for other people and machines, just as real.

All of this makes for a more sustainable source of growth and liquidity, and a less speculative nature of DePIN tokens. By focusing on everything real and tangible, DePINs link Web3 with the real world and the real-world economy, which is pretty much the definition of crypto adoption. All of this makes them ideally positioned to give bulls a solid reason to stay in the game and sustain the momentum, aiming for the long-term growth that only the real-world economy can provide.

And there lies our bull case for DePIN.

DePIN is Web3’s best ever shot at real world adoption – and it’s taking off right now.

peaqed your interest? You’ll love this deep dive into DePIN.

peaq is already being considered the home of DePIN. Wondering why? Check this out.